Blog

COMPLIMENTARY REFERRAL SERVICE

We Help You Navigate The

Senior Living Landscape

Compare Options. Get Clarity. Save Time. Reduce Stress

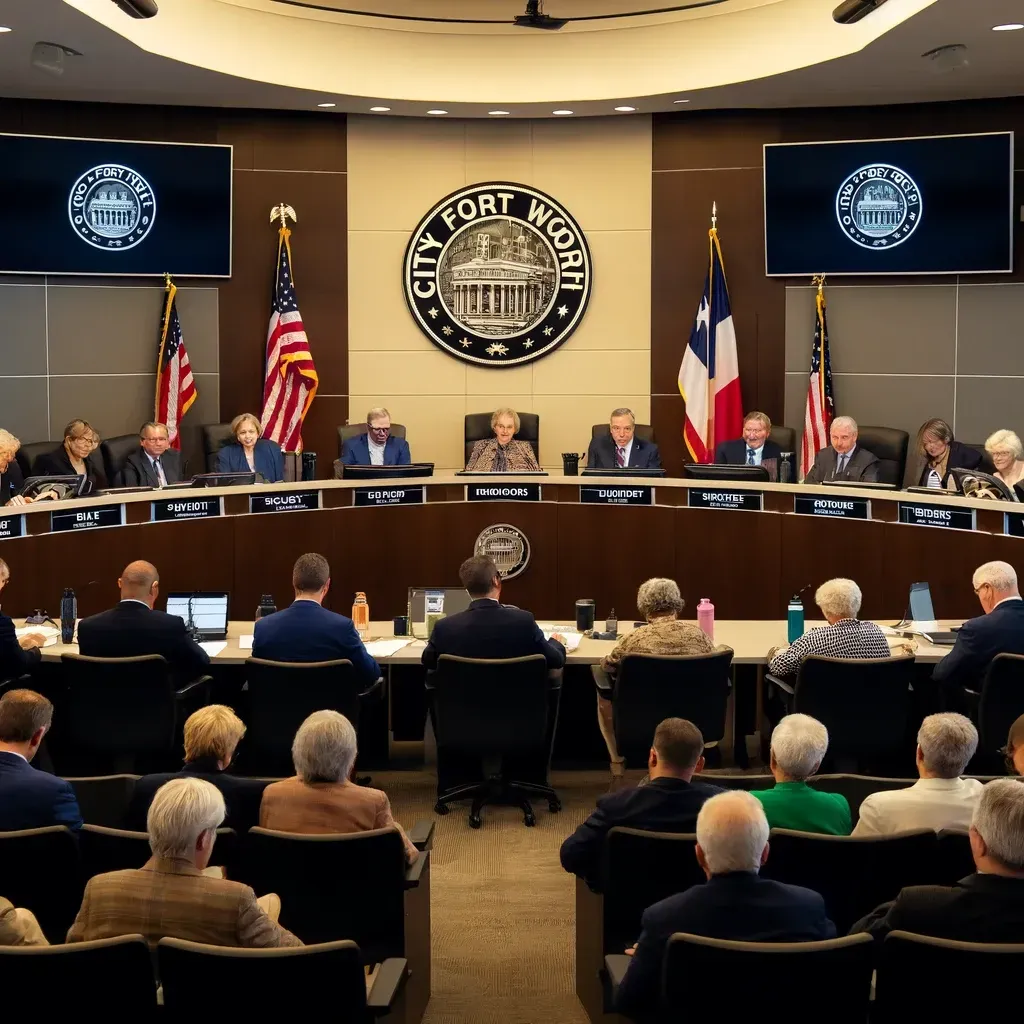

Fort Worth Enhances Property Tax Relief for Seniors and Disabled Residents

“We’re doing everything we can to support not only the elderly, but those who are disabled as well,” - Mayor Pro Tem Gyna Bivens

Fort Worth Enhances Property Tax Relief for Seniors and Disabled Residents

Introduction:

In a significant move to support its senior and disabled residents, Fort Worth City Council has approved an increase in the property tax exemption to $80,000. This decision, made unanimously on May 21, marks the second consecutive year of increases, demonstrating the city’s commitment to easing the financial burden on its elderly and disabled population.

The updated exemption means that eligible homeowners can exclude $80,000 from their home’s appraised value when calculating property taxes. This change will save homeowners with a $200,000 home approximately $538 in taxes, compared to $404 under the previous $60,000 exemption. The city's staff estimates the cost of this exemption to be around $940,609.

Mayor Pro Tem Gyna Bivens emphasized the council’s dedication to supporting vulnerable residents, stating, “We’re doing everything we can to support not only the elderly, but those who are disabled as well.” This effort is further supported by the city’s tax freeze policy, which caps the property tax bill for seniors and disabled residents at the amount paid the year they qualify.

This exemption is part of a broader effort by the council, which also includes maintaining or lowering the tax rate, to manage the financial impact on residents amid rising property values. The council will finalize the new tax rate and the 2025 budget in September.

Supporting Aging in Place

One of the critical aspects of this tax exemption is its potential to help seniors age in place. As the cost of living continues to rise, many seniors on fixed incomes find it increasingly challenging to manage their expenses. Property taxes can be a significant burden, particularly for those who own their homes but live on limited retirement savings or Social Security benefits.

By increasing the property tax exemption to $80,000, Fort Worth is providing meaningful financial relief to seniors, enabling them to allocate more of their limited resources to essential expenses such as healthcare, utilities, and groceries. This exemption can help seniors maintain their independence and remain in their homes longer, which is often a preferred option for aging individuals who value their established routines and communities.

Financial Stability for Fixed Income Households

For disabled residents, the financial relief provided by the increased exemption is equally important. Many disabled individuals live on fixed incomes, relying on benefits that do not always keep pace with inflation. The increased property tax exemption helps alleviate some of the financial pressures, allowing them to better manage their household budgets without the constant worry of rising property tax bills.

The exemption not only reduces the immediate tax burden but also offers long-term stability. With the city’s tax freeze policy, seniors and disabled residents are protected from future tax increases, ensuring that their property tax bills remain predictable and manageable over time. This stability is crucial for budgeting and financial planning, giving residents peace of mind and security in their homes.

Broader Community Benefits

The benefits of this tax exemption extend beyond the individual homeowners. By helping seniors and disabled residents stay in their homes, Fort Worth is fostering a more stable and connected community. Long-term residents contribute to the social fabric of neighborhoods, offering a sense of continuity and shared history that strengthens community bonds.

Additionally, supporting aging in place can reduce the demand for senior housing and assisted living facilities, which are often expensive and can be in short supply. By enabling seniors to stay in their homes, the city can help alleviate some of the pressure on these facilities and ensure that they are available for those who truly need them.

Applying for the Exemption

For those eligible, applying for the exemption is a straightforward process that can be done through the Tarrant Appraisal District. It’s important for seniors and disabled residents to take advantage of this benefit, as it can provide significant financial relief and support their ability to age in place comfortably.

In conclusion, the Fort Worth City Council's decision to increase the property tax exemption for seniors and disabled residents is a commendable step towards supporting the financial well-being and stability of its most vulnerable citizens. This initiative not only offers immediate tax relief but also promotes long-term financial security and community stability, making Fort Worth a more inclusive and supportive place for all its residents.

Author Bio: Logan Hassinger was inspired to start Sage Senior Support after witnessing the struggles of his wife’s parents as they cared for his wife’s beloved grandmother, affectionately known as “Mama.” Drawing on his own expertise in real estate, he founded Sage Senior Support to extend a helping hand to other families navigating similar circumstances. His company is based in Grapevine, Texas, and it services the entire Dallas-Fort Worth area.

A FREE RESOURCE FOR YOU AND YOUR FAMILY

Expert Unbiased Advice

At No Cost To You

Check out this "Ask The Expert" Session with Logan Hassinger of Sage Senior Support

TESTIMONIALS

What our clients are saying

Providing The Best Holistic

Approach to Senior Transitions

By using our websites and any content you agree to the terms of use and will not hold Sage Senior Support responsible for any results or lack thereof.

Facebook

Instagram

LinkedIn

Youtube

TikTok